CoreLogic does not have any plans to discontinue Fusion at this time, Bennett said. Cameron Paine, CEO of CTMLS, confirmed that the MLS had been offered Matrix, but said there was “no word” on which system CTMLS would ultimately go with.Ĭurrently, 50 MLSs representing more than 300,000 subscribers have access to Fusion alongside Tempo or MLXchange. In January, Connecticut MLS bailed on a plan to convert to Fusion and went on the hunt for a new system.

#MLS MATRIX INSTALL#

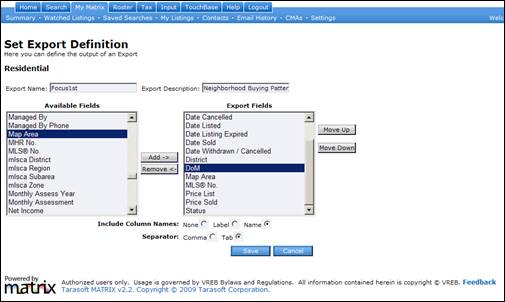

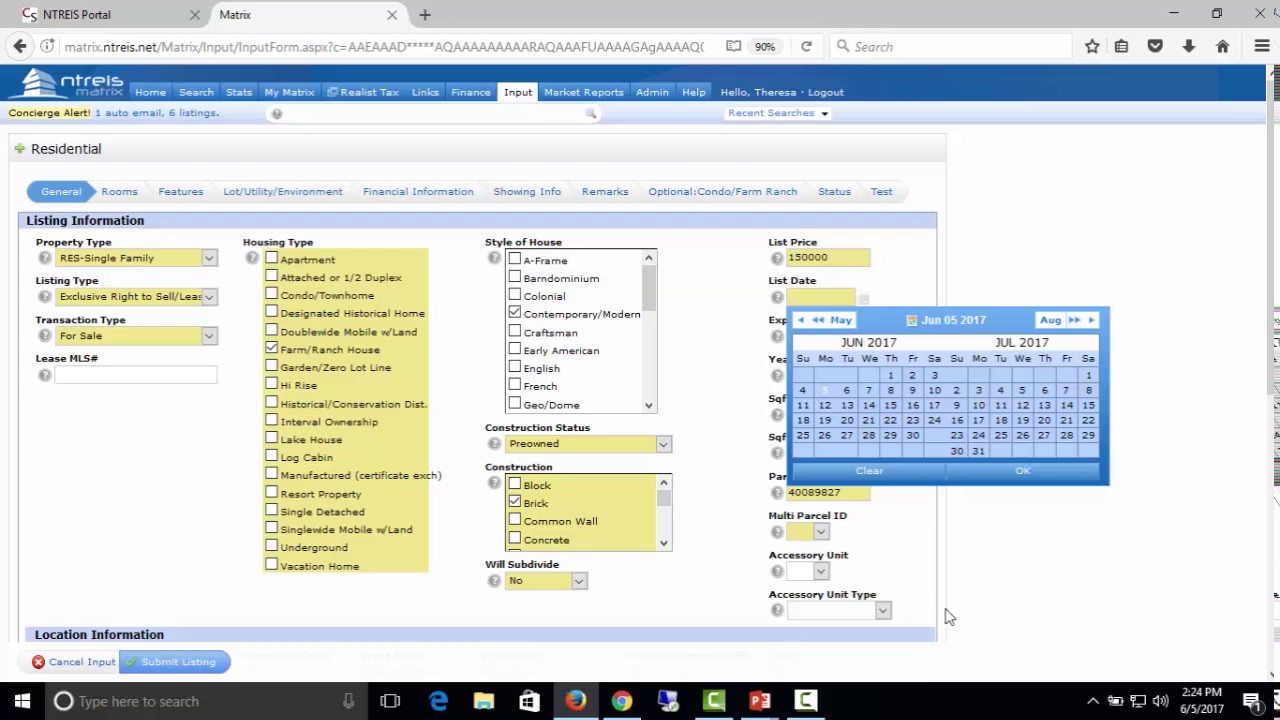

No existing customers will be charged to install Matrix, and customers can continue using Fusion until they want to make Matrix their primary system, Bennett said.įusion has disappointed some MLSs, primarily due to lack of compatibility with some mobile devices. He said CoreLogic plans to install Matrix “for all Fusion customers in order to provide them with an HTML-based, mobile-friendly option.” Many Fusion customers “have recently asked about installing Matrix - that was a key factor in our decision to proceed with the initiative,” Bennett told Inman News. CoreLogic announced last week that it had decided to install Matrix for all of its Fusion customers due to a “surge in demand” from new and existing customers. In December, CoreLogic got approval to hire 35 to 45 new people to improve the depth of Matrix implementation and support, and will invest millions of dollars in 20 to deal with the platform’s fast adoption rate and to “try to restore Matrix service back to where customers expect it,” Clareity said.Ĭhris Bennett, general manager of real estate solutions for CoreLogic, confirmed that the company is “hiring a significant number of additional personnel to help with all of the new Matrix installations and to increase support for our existing Matrix customers.” “While uptime, system speed, and staff support ratings remain excellent for the most part, ratings for vendor responsiveness to system change requests, enhancement requests and integrations have all suffered significantly.” “Matrix satisfaction has declined over the past four years, sending it from the top to the middle of the systems evaluated,” the Clareity report said.

That success has come with growing pains, however. Matrix is the primary MLS system for more than 250,000 subscribers and last year signed new contracts with several MLSs that the company expects will bring the system’s user count to about 600,000 by the end of 2015. Many respondents from CoreLogic’s other platforms also would not contract the vendor again: MLXchange (29 percent), TEMPO (20 percent) and Fusion (8 percent).

In Clareity’s report, while all surveyed customers of CoreLogic’s InnoVia platform said they would choose CoreLogic again, 38 percent of those using CoreLogic’s Matrix said they would not. Based on this and other information, I know that some people are going to be moving,” said Matt Cohen, Clareity’s chief technologist, when presenting the firm’s survey results to attendees at Clareity’s MLS Workshop in Scottsdale, Ariz., last week.Īn MLS survey released in December from real estate consulting firm WAV Group also suggested more MLSs will be shopping for new platforms. While customers of the top four vendors all said they would go with the same company if they had the decision to do over again, 40 percent of respondents with platforms from Millenium Real Estate Solutions (formerly D+H and Filogix) and Solid Earth each said they would be unlikely to or definitely would not choose the same vendor again.Īmong respondents using System Engineering Inc.’s NAVICA Revolution platform, 22 percent would not choose SEI again 16 percent of Rapatonni Corp.’s clients would not choose that vendor again. Multiple listing service platforms from Stratus Data Systems, Black Knight Financial Services, FBS and dynaConnections got top marks from users in an annual survey of MLS executives by real estate consulting firm Clareity Consulting.

0 kommentar(er)

0 kommentar(er)